Understanding Impact Of Inflation

Inflation is the rate at which the general level of prices for goods and services rises, eroding the purchasing power of money. It is a critical economic concept that affects everyone, especially when it comes to savings. Understanding the impact of inflation is crucial for financial planning, as it affects the cost of living and the real value of savings and investments.

ALSO READ THIS : Childhood Cuteness: Deepika Padukone & Ranveer Singh’s Rare Throwback Pics!

How Inflation Affects Savings

Inflation diminishes the value of money over time. This means that the money you save today will not have the same purchasing power in the future. As prices rise, the same amount of money will buy fewer goods and services. To mitigate the impact of inflation on savings, it’s essential to invest in assets that outpace inflation rates. Understanding the impact of inflation can help you develop strategies to protect your savings from losing value.

Inflation has a significant impact on savings by reducing what your money can buy in the future. The impact of inflation on savings highlights the importance of investing in assets that can outpace inflation

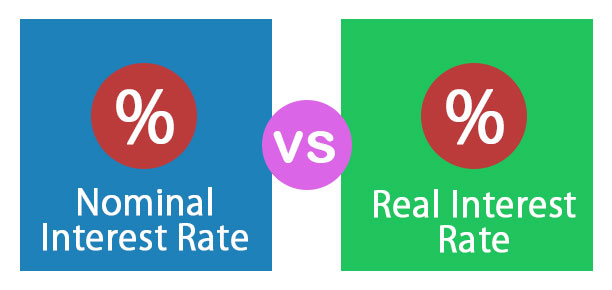

Real vs. Nominal Interest Rates

When considering savings, it’s essential to distinguish between nominal and real interest rates. Nominal interest rates are the stated rates on savings accounts or investments, while real interest rates adjust for inflation. A high nominal rate might seem attractive, but if inflation is higher, your real interest rate could be negative.

Real interest rates, unlike nominal rates, account for the impact of inflation, providing a clearer picture of the true return on investment after adjusting for changes in purchasing power over time. Real interest rates account for inflation, providing a more accurate measure of the return on investments after adjusting for the impact of inflation

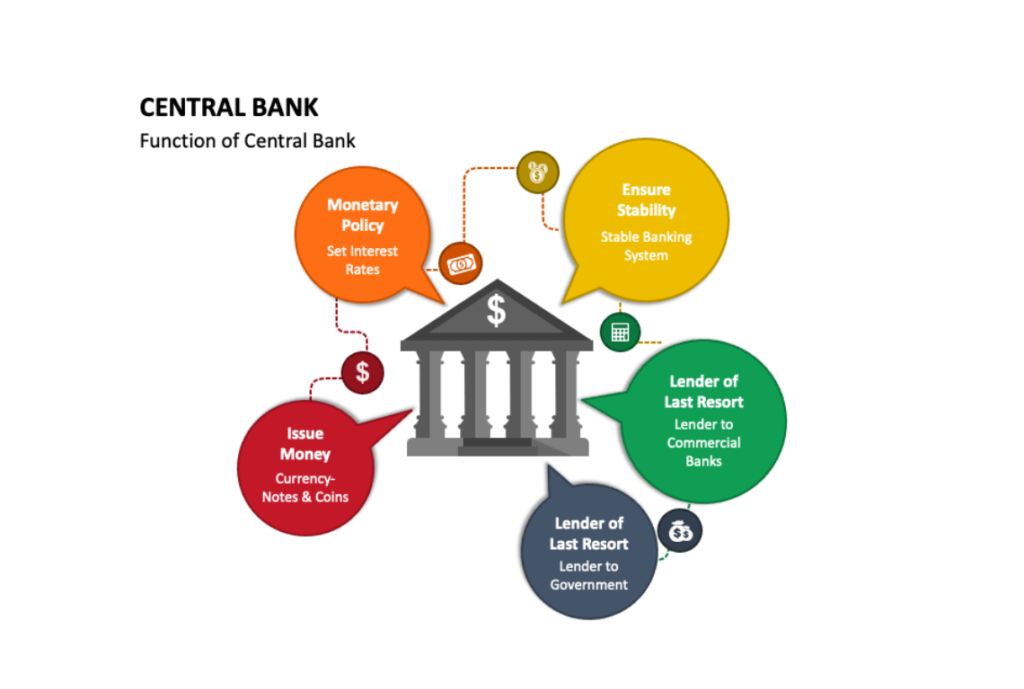

The Role of Central Banks

Central banks, like the Federal Reserve, play a crucial role in managing inflation. They use monetary policy tools to control inflation rates, which can influence interest rates and, subsequently, the returns on your savings. Central banks play a crucial role in managing the economy, particularly in controlling the impact of inflation through monetary policy and interest rate adjustments.

Protecting Your Savings from Inflation

To safeguard your savings from inflation, consider investing in assets that traditionally outpace inflation, such as stocks, real estate, or inflation-protected securities. Diversifying your investment portfolio can also help mitigate the risks associated with inflation. Protecting your savings from the impact of inflation requires strategic investment in assets that can outpace the erosion of purchasing power over time.

Protecting your savings from inflation involves diversifying investments into assets that historically outperform inflation rates, such as stocks, real estate, or inflation-protected securities, ensuring the preservation of your purchasing power over time.

Inflation-Protected Savings Vehicles

Some financial instruments are designed to protect against inflation. Treasury Inflation-Protected Securities (TIPS) are one such option. These are government bonds that adjust their principal value based on inflation, ensuring your investment maintains its purchasing power.

Inflation-protected savings vehicles, such as Treasury Inflation-Protected Securities (TIPS) or inflation-indexed bonds, shield investors from the erosive impact of inflation by adjusting interest rates or principal values in line with changes in consumer prices.

Long-term Financial Planning

Inflation should be a critical consideration in your long-term financial planning. By understanding its impact and taking proactive steps, you can protect your savings and ensure they grow in real terms over time. Long-term financial planning should consider the impact of inflation to ensure that savings and investments grow in real terms and maintain purchasing power over time.

Conclusion

The Impact of Inflation has a significant impact on savings, but with careful planning and informed investment choices, you can mitigate its effects. Stay informed about economic trends and consider diverse investment options to safeguard your financial future.